Meet Stella

First there was Siri, then Alexa. Now we have Stella. Stella is our SMART Spreadsheet tool that can help brokers generate preliminary health insurance quotes in a fraction of the time, giving them more time to analyze the options and make a recommendation to their clients.

Stella has already been tested in a busy production environment, and now we’re ready to roll this tool out to brokers in select markets in Texas. If you like efficiency and hate wasting time, keep reading…

Stella lets brokers be brokers

Some agents feel that they spend all of their time doing mundane tasks like running quotes with the various carriers in the market, even when they know that some of those carriers won’t be competitive, and then data entering the quoted rates into an Excel spreadsheet so their small group clients can see all of their options in an apples to apples format.

No more! Stella can do the grunt work in a fraction of the time. This is especially important during the condensed selling season at the end of the year. But Stella isn’t just a tool for the fourth quarter — she can help brokers sell more business all year long.

What can Stella do?

Like all quote spreadsheets, Stella presents the various plan options in a similar format, making it easy for employers to compare those options and quickly see how one plan varies from the other. But she does a whole, whole lot more than that.

(1) Easy-to-read benefit comparisons

Because the primary purpose of a quote spreadsheet is to narrow down the options to a handful of “finalists,” our SMART Spreadsheet does not include every detail of every plan. Rather, it focuses on those benefits that are most important to employers and employees and most likely to be deciding factors when selecting a carrier and choosing which plan(s) to offer, like deductible, coinsurance, and out-of-pocket limits, doctor and Rx copays, and, of course, monthly premiums.

In most rating areas, every fully-insured ACA metallic plan is quoted, though you can choose which plans to show to your clients. There are a number of different views available with varying levels of detail, and there is even an option to sort and filter the results based on the factors that are most important to your clients.

(2) But wait – there’s more: 60-second quotes!

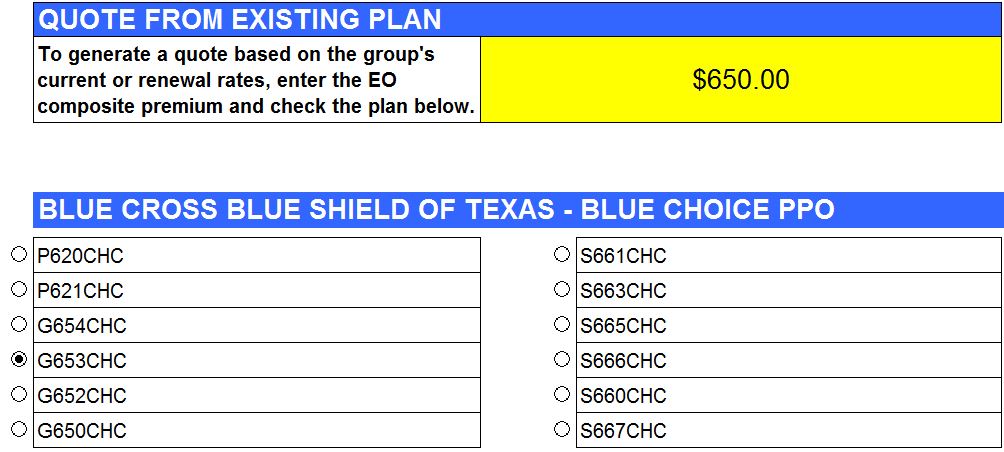

The most amazing feature of the smart spreadsheet, though, is that you can enter the employee-only rate for just one plan and Stella automagically fills in all of the other rates for all of the other plans in the market.

Let us repeat that: all you have to do is enter the single rate for a single plan — it could be the group’s current plan or any other plan from a group quote or renewal offer — and Stella calculates the employee and dependent rates for every fully-insured small group plan offered by that carrer and every other carrier in the market. The spreadsheet-generated rates might vary from the carrier’s quotes by a couple pennies due to rounding, but when you’re dealing with premiums in the hundreds of dollars, who cares?

(3) Stella can even create a quote from scratch

If the group does not currently have coverage or you don’t have the quoted rates for any plan options, no problem — the SMART Spreadsheet can create a quote based on census info. You need to enter, at a minimum, the coverage type for each employee (EO, ES, EC, or EF) and the DOBs for each covered member, just like you normally would when running a quote. The difference is that you only have to do it once (instead of running separate quotes on each carrier’s website), and there’s no data entry afterwards — the rates are automatically filled in on the spreadsheet for you.

This feature is especially useful if you want to quickly see how a change in the census (like adding or dropping a dependent or an older employee dropping off the plan and going onto Medicare) might impact the group’s rates.

See Stella in action—request a demo

We’d love to show you how Stella works. And it’ll only take a few minutes.

Request a demo.

Hire Stella to do your spreadsheets

If you’ve seen enough and are ready to get your very own SMART Spreadsheet, here’s what you need to know:

- Carrier rates generally change on a quarterly basis, so we release the spreadsheets one quarter at a time, usually with a few updates to make it even better.

- We do require a one-year committment, but you can pay quarterly if you’d like. Brokers who pay for a year at a time get a 20% discount off the quarterly rate.

PLAN - PRICE

Description

PAID QUARTERLY

$ 1,995 / yr + tax

If you'd rather space our your payments, you can "hire" Stella for three months at a time for just $499. Annual committment required.

PAID ANNUALLY

$ 1,595 / yr + tax

Pay annually and you'll save 20% off

the quarterly price. This is the best way to

save time and money all year long.

If you’d like to help make Stella even better, sign up to be a BenefitLab “guinea pig.” You’ll also be among the first to test out new features as they’re added and will have the opportunity to provide feedback and suggestions based on your experience. Hurry, though — there are only a limited number of guinea pig spots available.

FREQUENTLY ASKED QUESTIONS

If we use the SMART Spreadsheet, do we still need to run the carrier quotes?

Yes, this tool does not replace the carriers’ quotes or eliminate the need to run quotes through the carriers’ websites. In fact, when you sell and submit a new group, most carriers require that you first run a quote through their system. Rather, the tool allows brokers to generate preliminary health insurance rates quickly and easily and reduces the chance of data entry errors when transferring the rates to the spreadsheet. You’ll still want to spot-check to make sure the rates are correct. Plus, the carrier’s quote contains important information about limitations and exclusions, participation and contribution requirements, and ancillary benefits like dental insurance and life insurance that are not included on the SMART Spreadsheet.

How sure are you that the rates are right?

Ultimately, it is the broker’s responsibility to ensure the accuracy of the quoted rates, and final rates are always based on final enrollment. That said, we have tested and re-tested this tool and have found it to be quite accurate. Employee-only rates might differ from the carrier rates by a couple pennies due to rounding, and, depending on the size of the group, the total monthly premium might be off by a dollar or so. The proper disclaimers are included on the spreadsheet, and we believe the slight rounding variances are a small price to pay given the time savings. On most pages of the spreadsheet, we round the premium up to the next dollar since it’s easier to compare whole dollar amounts.

Is Stella still in beta mode?

No, we’ve already used the SMART Spreadsheet in a live production environment during the busy fourth quarter. It worked like a charm and kept agents and account managers from having to work long hours like they did the year before. That experience, ultimately, is what made us decide to start BenefitLab —Stella was way too useful for us to keep her to ourselves.

What if I’m not appointed with one of the carriers on the SMART Spreadsheet?

We are not affiliated with any insurance carriers and understand that different insurers have different policies about whether brokers can get a quote without being appointed. However, we do know that you can only sell a plan if you’re appointed with the carrier, so, to be fair, we would ask that you make sure you’re appointed with any carrier that you are showing to your clients.

Can the SMART Spreadsheet quote level-funded plans, Association Health Plans, and other non-metallic options?

No, at this time the SMART Spreadsheet tool only provides preliminary quotes for small group, fully-insured ACA metallic plans. These are the plans that follow the Affordable Care Act’s modified adjusted community rating rules. Level-funded plans, Association Health Plans, and other options available to small employers do not follow the same rating rules, so it would be difficult to plug the formulas into a spreadsheet.

That said, we believe Stella is an indispensable tool if you sell those out-of-the-box options. Why? Because most employers want to see all of their plan options, even if a non-metallic solution is best for them. How can an employer really know that they’ll do better with level funding (or how much better they’ll do) without also seeing the rates for fully-insured plans? The SMART Spreadsheet allows you to generate that price comparison in a minute or less, not an hour or more.

*** We are working on an AHP qualifer tool that will help you understand whether it’s worth the time to get an Association Health Plan quote. Our preliminary testing is promising, and we believe that the finalized version will help save agents time by identifying the best candidates for an AHP. The tool will available in the next few weeks.

Can the SMART Spreadsheet be used for ancillary benefits like dental or vision?

No, at this time theSMART Spreadsheet tool only provides preliminary quotes for small group, fully-insured ACA metallic health plans.

Does the SMART Spreadsheet provide enough info for a client to make a buying decision?

The benefits shown on the SMART Spreadsheet are those that we believe are most important to most employers. Benefits that are the same across plans, like preventive care and the annual/lifetime maximum, are not included since those are not deciding factors. We also don’t show separate facility copayments or out-of-network benefits on most of the illustrations. You’ll likely need to provide supplemental material or at least have a discussion with your clients about the benefits that are not displayed.

Also, some carriers include additional perks and other benefits that do not spreadsheet easily, like dental and vision discounts, gym memberships, wellness programs, etc. These can certainly factor into an employer’s decision and should be discussed with every client and prospect.

Why do you charge so much?

The real question is why do we charge so little? If you pay annually and sign up to be a guinea pig, your cost is just over $100 per month. That’s roughly what you would earn in commission on a five or six life group. We believe the SMART Spreadsheet can help you sell a lot more business than that. Plus, it’ll save you a ton of data entry time, giving you more time to visit with prospective clients.

Is Stella available statewide?

No, just in the larger markets in Texas (DFW, Houston, Austin, San Antonio, and Corpus Christi to start). We’ll likely expand into some other areas, but we don’t believe it makes sense to roll it out statewide. There are some rating areas with just a single county, and others have very few carriers available. We believe the quote comparison tool is more helpful in areas with multiple carriers. If we’re not yet in your area and you believe we should be, let’s talk.

When I sign up, do I get the spreadsheet for all available rating areas?

Yes, we’ll provide separate quote spreadsheets for each area where they’re available. And if we expand into other markets, you’ll have access to those spreadsheets as well.

Is any training available to brokers who purchase the SMART Spreadsheet?

Yes, when you purchase the SMART Spreadsheet from BenefitLab, we will invite you to attend webinar training events with other agents. We’ll also be recording video tutorials with tips and tricks to help you make better use of all of Stella’s features.

Additionally, we’ll provide some supplemental tools to help make your job easier. These include a census form you can send to clients and prospects (you can copy and paste from this form into the smart spreadsheet to generate a quote) and other tools that will be added in the coming weeks.

If there are multiple brokers in an agency, do we need to purchase more than one SMART Spreadsheet?

Yes, when you purchase the SMART Spreadsheet tool, the annual license is good for a single producer. Certainly, the producer can share the tool with an account manager or someone else in the office who runs quotes for him or her, but if there are multiple producers, then multiple licenses are required. That said, we will offer bulk discounts for bigger agencies. Contact us for more information.