No, employers are not required to allow special enrollment onto a group health plan due to cost increases on existing individual or group health policies.

However, as Word & Brown explains, cessation of employer contributions toward the cost of health insurance can create a special enrollment opportunity.

Here is the Word & Brown article: https://www.wordandbrown.com/compliance/a-closer-look-at-hipaa-qualifying-events

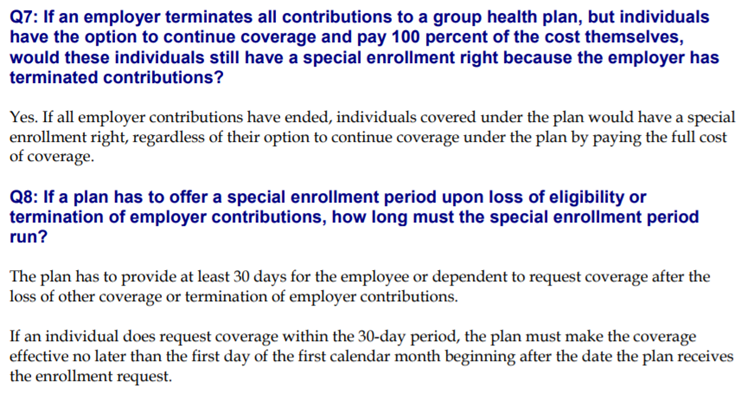

From the Department of Labor’s FAQ document on HIPAA special enrollment rights: https://www.dol.gov/sites/default/files/ebsa/about-ebsa/our-activities/resource-center/faqs/hipaa-compliance.pdf